The Employee Retention Credit is only obtainable with respect to wages paid after March 12, 2020, and before January 1, 2021. Fill out the shape above to start your software and determine should you qualify. Based on current laws, it is clear that the IRS and Treasury Department are clamping down on fraud perpetrated by bad actors who took advantage of pandemic-related funding. After the unhealthy actors are brought to justice, the IRS will undoubtedly focus more of its consideration that took advantage of those funding packages. The Employee retention tax credit would possibly present large benefits to a tax-exempt organization, corresponding to a church, museum, nonprofit hospital, and extra.

Full-time employees in 2019 as calculated per Affordable Care Act tips. Aprio’s COVID relief advantages consultants are often featured in a few of the nation’s most respected publications for his or her ERC- and PPP-related expertise. Contact our ERC specialists to be taught when you qualify for the ERC or go to our reduction portal to get began. “Turnaround time when having to file an amended return from the IRS is ninety to 120 days whereas when filing an authentic return, the turnaround is 30 to 60 days,” she famous.

- Even should you explored the ERC within the early days of Covid-19, you might end up pleasantly stunned should you take another look at present.

- However, restoration startup companies have to claim the credit score via the end of 2021.

- However, this little-known authorities help has large advantages for businesses.

Government orders—on federal, state, and local levels—are a important factor that many enterprise house owners had to adapt to over the past yr and a half. Examples of affected companies include a restaurant that might not let prospects dine indoors or a producer that had to gradual their operations because of new health and safety restrictions. Once you’ve determined the total quantity of qualifying wages paid, multiply that number by 50% to calculate the employee retention credit. For instance, if an employer has 10 eligible workers and pays each worker $10,000 in qualifying wages during 1 / 4, the employer could be entitled to a credit score of $50,000 ($10,000 x 10 workers x 50%). The credit score is the same as 50% of the qualifying wages paid to eligible workers, as much as $10,000 of wages per worker per quarter. To calculate the worker retention credit score, first determine the number of eligible workers and the whole amount of qualifying wages paid to those staff during the relevant quarter.

ERC specialists working in accounting departments and for tax preparers can quickly evaluate whether an organization is entitled to the credit and provide any needed steerage. If the standards are met, these professionals can file amended payroll tax returns for the qualifying quarters and submit them to the IRS. Employers reported whole certified wages and the associated COVID-19 worker retention credit on Form 941 for the quarter in which the qualified wages had been paid. The credit score was allowed in opposition to the employer portion of social safety taxes (6.2% rate) and railroad retirement tax on all wages and compensation paid to all staff for the quarter. If the amount of the credit exceeded the employer portion of those federal employment taxes, then the surplus was handled as an overpayment and refunded to the employer. The ERC program gave eligible employers a payroll tax credit for persevering with to make use of Americans in the course of the pandemic.

It provided some relief for struggling businesses who kept workers on their payrolls even when government pandemic restrictions required them to suspend operations or affected their gross receipts. This law allowed certain hardest-hit businesses — severely financially distressed employers — to say the credit against all employees’ qualified wages as a substitute of simply those that aren’t providing providers. These hardest hit companies are outlined as employers whose gross receipts in the quarter are lower than 10% of what they were in a comparable quarter in 2019 or 2020. This solely applies to the third quarter of 2021 for businesses that aren’t Recovery Startup Businesses.

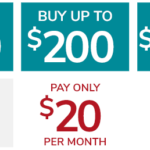

Even should you explored the ERC in the early days of Covid-19, you would possibly find yourself pleasantly shocked when you take another look at present. The ERC was expanded considerably for the 2021 tax year, with modifications together with increasing the per worker maximum to $7,000 per employee in 2021 and increasing the definition of “small business” beneath this system umbrella to 500 from 100 employees. Yes, the Employee Retention Credit is a provision to supply reduction and financial safety to taxpayers, but the IRS is not giving money away. The best thing you can do is provide full documentation now to see if you qualify. If your business grew throughout quarantine, but you proceed to experienced a full/partial suspension, some bills may qualify for the Employee Retention Credit.

CPAs and accounting firms can now companion with ERC specialty corporations to provide ERC services to their shoppers while avoiding the additional work and liability of handling ERC filings themselves. Your employee rely restriction is predicated on the FTE (full-time equivalent) employees you may have, which is more concerned than counting those within the workplace. You can still be an eligible employer should you carry out the calculations accurately.