Catalogues for bad credit are a valuable resource for individuals looking to access affordable shopping options despite financial constraints. These catalogues cater specifically to individuals with poor credit scores, offering them the opportunity to shop for a wide range of products without the need for a traditional credit check. This accessibility can be a game-changer for those struggling to obtain credit through traditional means, providing them with a gateway to affordable shopping that might otherwise be out of reach.

One of the key impacts of catalogues for bad credit is the ability to rebuild credit through responsible shopping habits. By making regular payments on purchases made through these catalogues, individuals can demonstrate their ability to manage credit effectively, ultimately improving their credit score over time. Additionally, these catalogues often offer flexible payment options, making it easier for individuals to budget for their purchases and avoid falling into further financial hardship. In the upcoming section, we will explore the key takeaways of using catalogues for bad credit, including tips for maximizing their benefits and avoiding potential pitfalls. Stay tuned for valuable insights on how to make the most of this valuable shopping resource.

key Takeaways

1. Catalogues for bad credit offer a convenient way for individuals with poor credit scores to access affordable shopping options for a wide range of products.

2. These catalogues typically do not require a credit check, making them accessible to individuals who may have difficulty obtaining credit through traditional means.

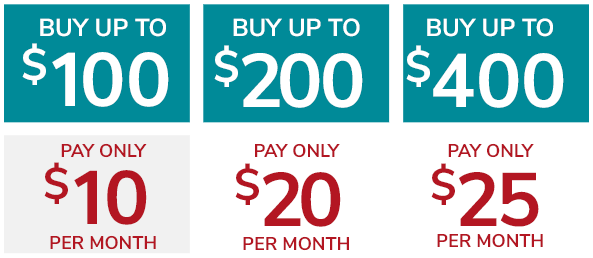

3. By using catalogues for bad credit, consumers can spread the cost of purchases over time through installment plans, helping them manage their budget more effectively.

4. Many catalogues for bad credit also offer promotional discounts, rewards programs, and flexible payment options to incentivize loyal customers and encourage repeat business.

5. It is important for consumers to use catalogues for bad credit responsibly, making payments on time and avoiding accumulating excessive debt in order to improve their credit scores over time.

What are Catalogues for Bad Credit and How Can They Help You Save Money?

When you have bad credit, it can be difficult to find affordable shopping options. Fortunately, catalogues for bad credit offer a solution by allowing you to shop for a variety of products without the need for a credit check. These catalogues provide an opportunity for individuals with poor credit to purchase essential items such as clothing, electronics, furniture, and more. In this article, we will explore the benefits of using catalogues for bad credit and how they can help you save money.

How Do Catalogues for Bad Credit Work?

Catalogues for bad credit work similarly to traditional catalogues, with one major difference – they do not require a credit check for approval. This means that individuals with poor credit or no credit history can still access a wide range of products through these catalogues. To get started, simply browse the catalogue, select the items you wish to purchase, and apply for credit with the catalogue company. Once approved, you can choose to pay for your purchases in full or in monthly instalments.

The Benefits of Using Catalogues for Bad Credit

There are several benefits to using catalogues for bad credit. Firstly, they provide an opportunity for individuals with less-than-perfect credit to shop for essential items without the worry of being rejected. Additionally, catalogues for bad credit often offer competitive prices and flexible payment options, making it easier to manage your budget. Finally, using catalogues for bad credit can help you rebuild your credit history over time, as many companies report your payment history to credit bureaus.

How to Choose the Right Catalogue for Bad Credit

When selecting a catalogue for bad credit, it’s important to consider factors such as the product selection, pricing, and payment options. Look for catalogues that offer a wide range of products to suit your needs, competitive prices that fit within your budget, and flexible payment plans that work with your financial situation. Additionally, read reviews and check the catalogue company’s reputation to ensure you are working with a trustworthy provider.

Maximizing Your Savings with Catalogues for Bad Credit

To make the most of your shopping experience with catalogues for bad credit, consider these tips:

- Take advantage of introductory offers and discounts to save money on your first purchase

- Compare prices and interest rates between different catalogues to ensure you are getting the best deal

- Make timely payments to avoid additional fees and improve your credit score over time

- Utilize budgeting tools and resources provided by the catalogue company to help you manage your finances effectively

FAQs about Catalogues for Bad Credit: Your Gateway to Affordable Shopping

1. Can I use catalogues for bad credit to purchase items?

Yes, catalogues for bad credit allow individuals with poor credit to shop for a variety of items and pay for them over time. These catalogues often have flexible payment options to accommodate different financial situations.

2. Will using catalogues for bad credit negatively affect my credit score?

Using catalogues for bad credit responsibly can actually help improve your credit score over time. Making timely payments on your purchases demonstrates financial responsibility to credit agencies.

3. Is there a limit to how much I can spend with catalogues for bad credit?

Each catalogue for bad credit sets its own spending limits based on your creditworthiness. As you build trust with the catalogue company by making timely payments, your spending limit may increase.

4. Can I return items purchased with catalogues for bad credit?

Most catalogues for bad credit have a return policy that allows you to return items within a certain timeframe. Be sure to review the return policy before making a purchase to understand any restocking fees or return shipping costs.

5. Are there any fees associated with using catalogues for bad credit?

Some catalogues for bad credit may have membership fees or interest charges for purchases made over time. It’s important to carefully read the terms and conditions of the catalogue to understand any fees associated with using their service.

6. How long does it take to get approved for a catalogue for bad credit?

Approval times for catalogues for bad credit vary depending on the company and your credit history. Some catalogues offer instant approval, while others may take a few days to review your application.

7. Can I use catalogues for bad credit to build my credit history?

Yes, using catalogues for bad credit responsibly can help you build a positive credit history over time. Making on-time payments and managing your purchases wisely demonstrates financial responsibility to credit agencies.

8. Are there any restrictions on what I can purchase with catalogues for bad credit?

Most catalogues for bad credit allow you to purchase a wide range of items, from clothing and electronics to home goods and furniture. However, certain items, such as gift cards or prepaid cards, may be restricted due to potential fraud risks.

9. Can I use catalogues for bad credit to shop online?

Yes, many catalogues for bad credit offer online shopping options, allowing you to browse and purchase items from the comfort of your own home. Online shopping with catalogues for bad credit provides convenience and accessibility for individuals with poor credit.

10. What should I do if I have trouble making payments on my catalogue for bad credit purchases?

If you are having difficulty making payments on your catalogue for bad credit purchases, it’s important to contact the company as soon as possible. They may be able to work with you to adjust your payment schedule or provide financial assistance options.

Final Thoughts on Catalogues for Bad Credit: Your Gateway to Affordable Shopping

Overall, catalogues for bad credit can be a valuable resource for individuals looking to shop affordably and responsibly. By understanding the terms and conditions of the catalogue, making on-time payments, and managing purchases wisely, you can rebuild your credit history while enjoying the convenience of shopping with flexible payment options. Remember to use catalogues for bad credit as a tool to improve your financial situation and enhance your shopping experience.